Russia’s July 17 withdrawal from the Black Sea Grain Initiative (BSGI), has sparked fears of reduced exports of wheat and other key commodities to developing countries, along with other market disruptions.

The grain deal, in place for almost a year, had clear benefits for global markets and food security. In the midst of war, it allowed Ukraine to export 33 million metric tons (MT) of grains and other agricultural products from its Black Sea ports—with most going to developing countries. The BSGI also contributed to a decline in international prices of staple foods and helped to sustain global food supplies.

The end of the BSGI presents an uncertain moment for grain-importing countries in sub-Saharan Africa (SSA). Russia, seeking to rebut international criticism of its BSGI pullout, has claimed that the deal’s benefits to developing countries—particularly in Africa—were overstated. Speaking at a Russia-Africa summit in St. Petersburg on July 27, President Vladimir Putin said Russia was ready to replace Ukrainian grain exports to Africa and offered to provide Burkina Faso, Zimbabwe, Mali, Somalia, the Central African Republic, and Eritrea with 25,000-50,000 MT of free grain each in the next three to four months.

How has the war, and the BSGI, affected the important global grain trade with sub-Saharan Africa, a key element of regional food security? In this post, we use a new source of international trade data to examine the impacts of the war on Russian and Ukraine wheat exports to SSA, as well as exports from other regions, and possible effects of renewed interruptions.

Importance of wheat exports to sub-Saharan Africa

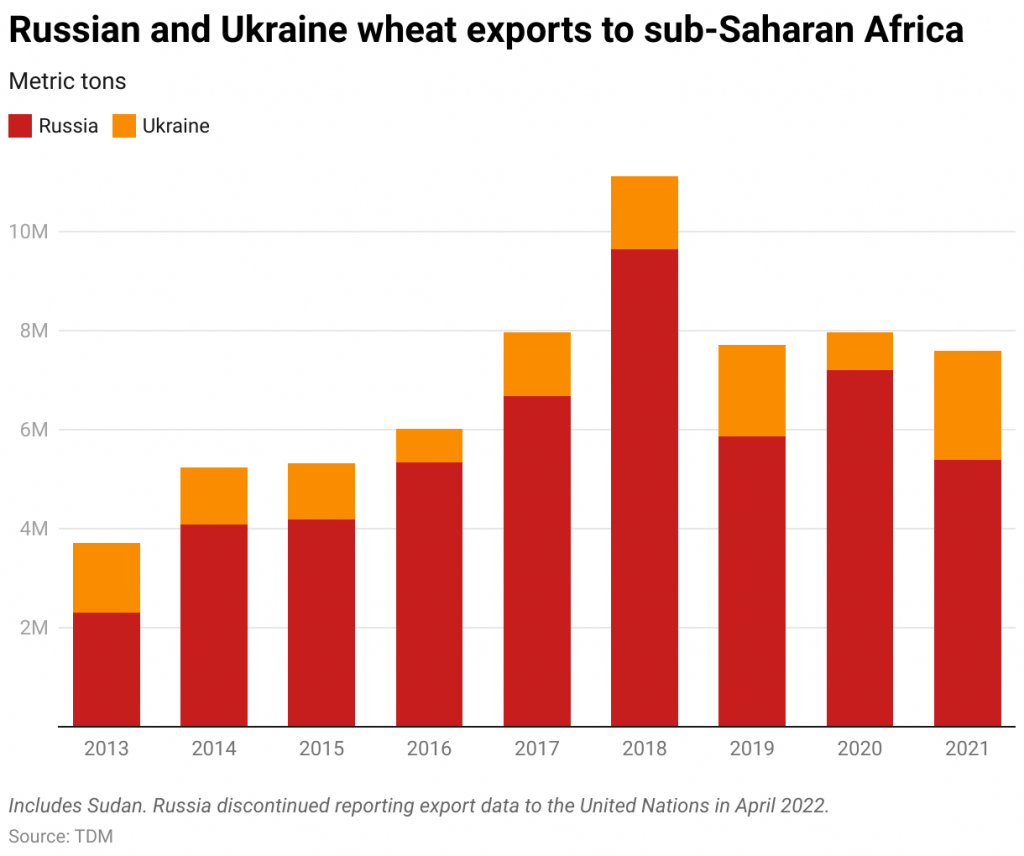

While wheat is not a major staple in much of SSA, it remains an important source of calories in many countries, particularly for urban consumers. Most of these countries depend heavily on imports to meet wheat demand. In the years leading up to the war—which began in February 2022—wheat exports from Russia and Ukraine had increased substantially; in 2021 they accounted for one third of total wheat imports by SSA. From 2013 to 2017, wheat exports from Russia and Ukraine to SSA (including Sudan) doubled and then remained stable at about 8.5 million MT from 2017 to 2021 (Figure 1). Exports to SSA averaged about 6% of total wheat exports for Ukraine over calendar years (CY) 2019-2021 and averaged about 18% of total Russia wheat exports over the same period.

Figure 1

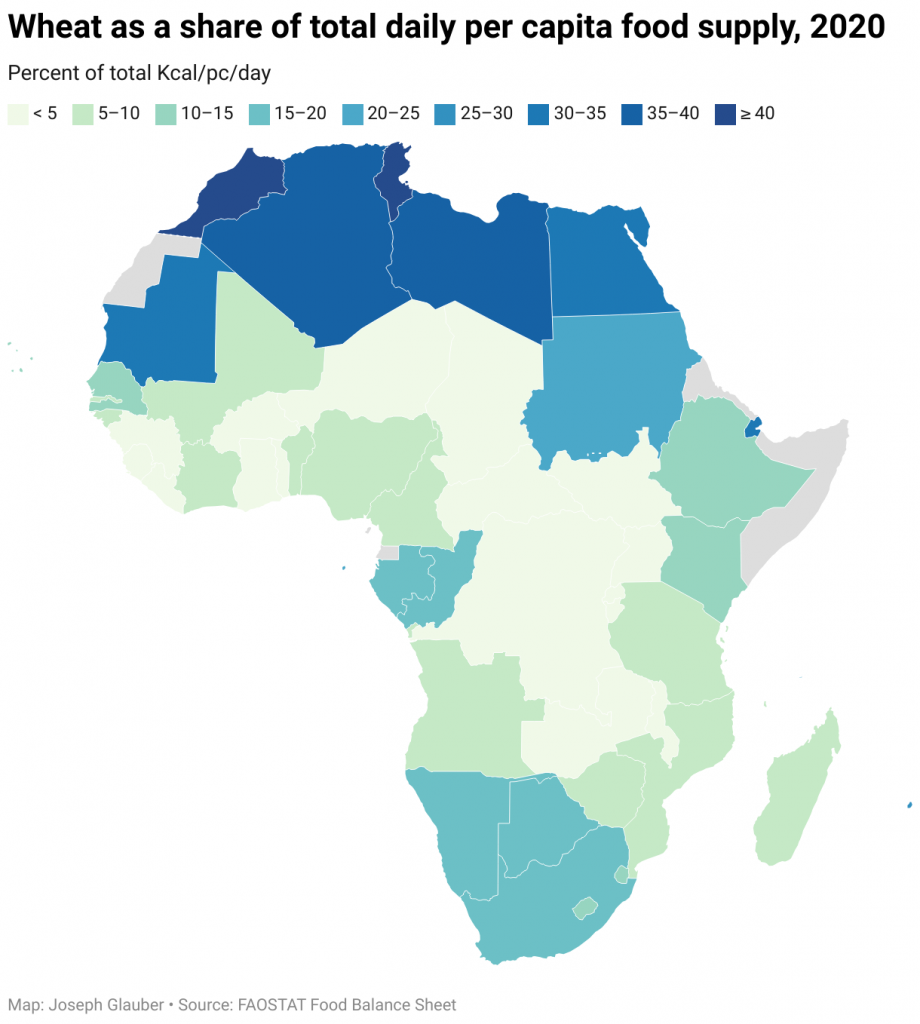

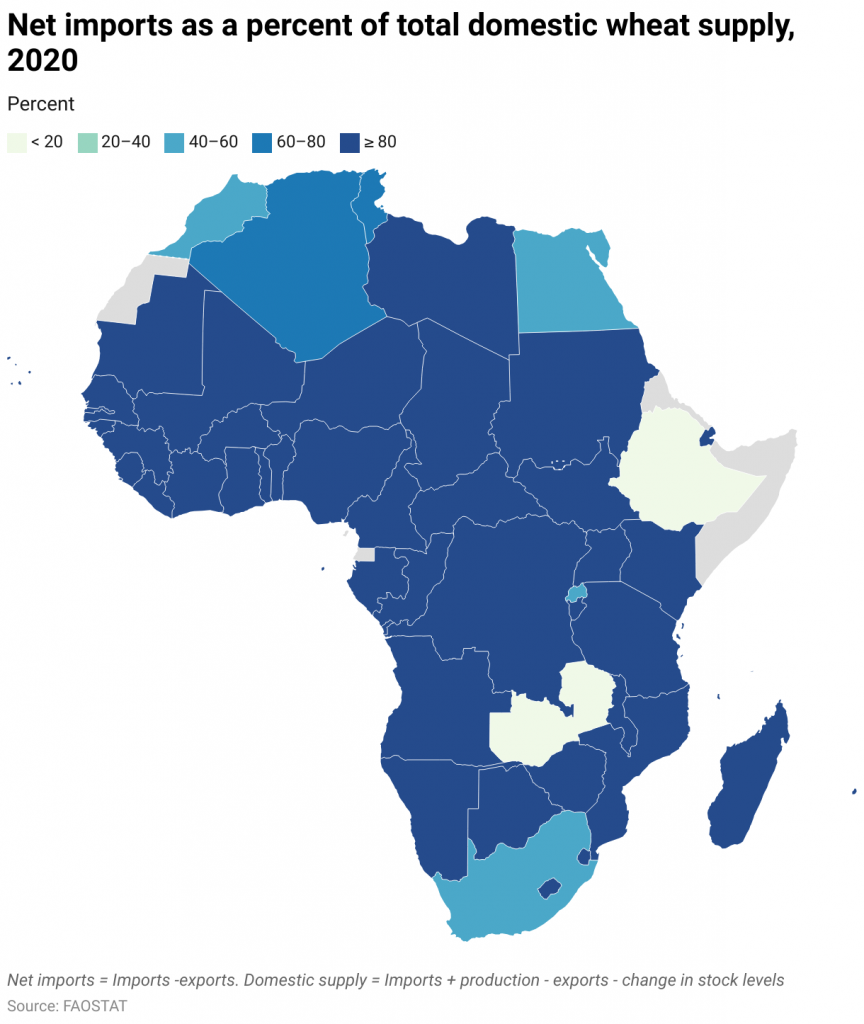

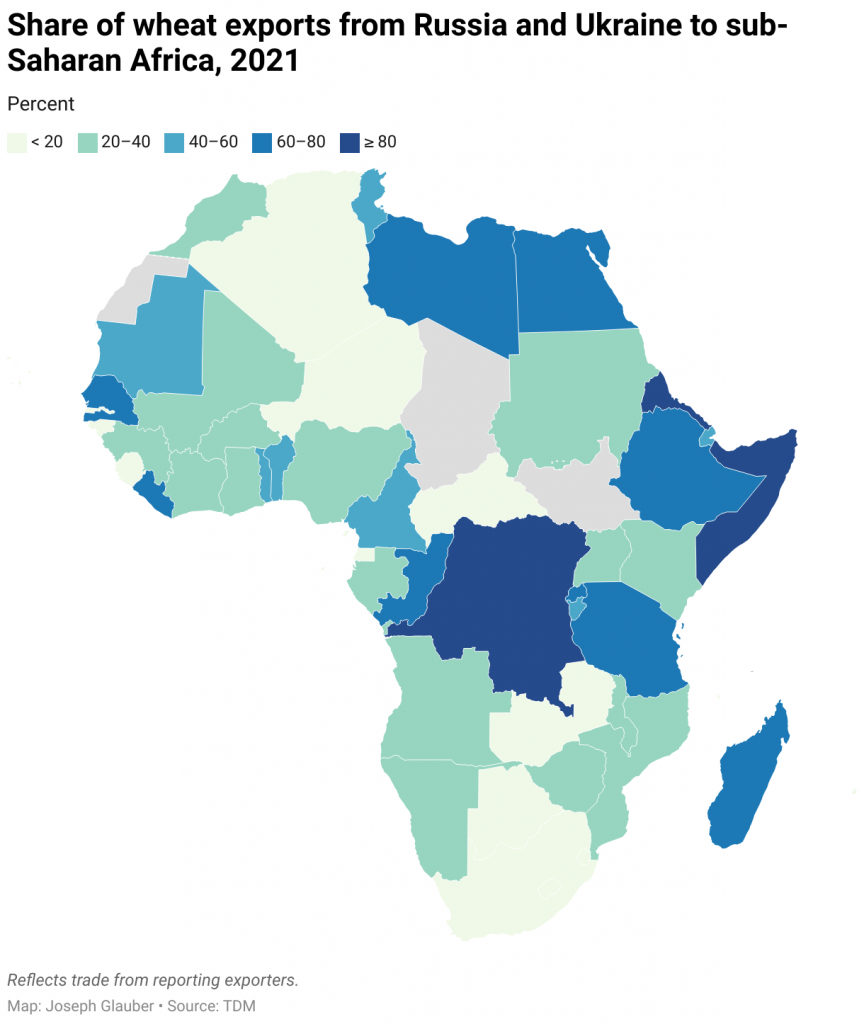

Outside of East and Southern Africa, most of SSA has unfavorable conditions for growing wheat. As a result, a majority of countries in SSA import almost all of their wheat supplies (Figure 3). Exceptions are Ethiopia, Rwanda, South Africa, and Zambia, where domestic wheat production meets a large proportion of domestic food needs. And with the rise of countries in the Black Sea area as major wheat exporters, SSA had become increasingly dependent on Ukraine and Russia for a significant share of wheat imports prior to the war (Figure 4).

Figure 3

Impacts of the war on wheat supplies to sub-Saharan Africa

Assessing the impact of the war on wheat exports to SSA is complicated by the lack of reliable trade data. As of early 2022, Russia stopped reporting on its exports to international data systems, notably the UN’s COMTRADE. At the same time, many food-importing countries in Africa report the volumes and origins of wheat imports with long time lags. Finally, a comparison of the data reported from importing and exporting countries reveal discrepancies that require careful analysis.

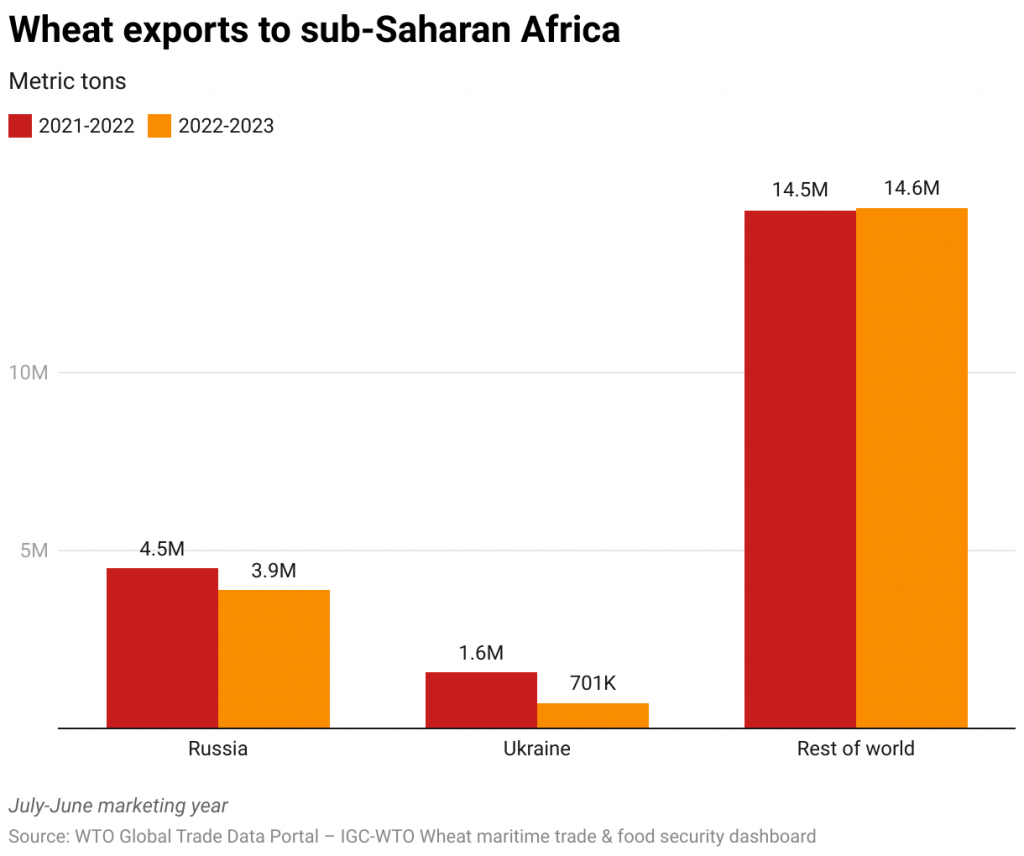

Given these data shortcomings, we turn to a new data source that provides real-time information on shipments of grains around the world compiled by the World Trade Organization (WTO) and the International Grains Council (IGC) and available via a new dashboard. These data are reported on a biweekly basis. In Figures 5-7 below, we report on data available through June 30, 2023, covering nearly the entire period the BSGI was in effect. The shipment data seem to provide a reasonable proxy for the traditional trade data. For example, the shipment data report Russia exported 4.5 million MT of wheat to SSA during the July 2021 to June 2022 marketing year—similar in magnitude to the calendar year exports reported for 2021 shown in Figure 1.

The shipment data suggest that global wheat exports to sub-Saharan Africa were down almost 7% (-1.4 million MT) in the 2022-2023 marketing year compared to the previous year (Figure 5)—with most of that decline due to reduced exports from Ukraine and Russia. In the same period, Russia’s total wheat exports to SSA declined by about 13% (-600,000 MT), and Ukraine’s wheat exports to SSA were down 55% (-870,000 MT). This reflects the reality that while the BSGI had an impact, Ukraine still faced significant obstacles to exporting wheat and other commodities. By contrast, exports from the rest of world were largely unchanged.

Figure 5

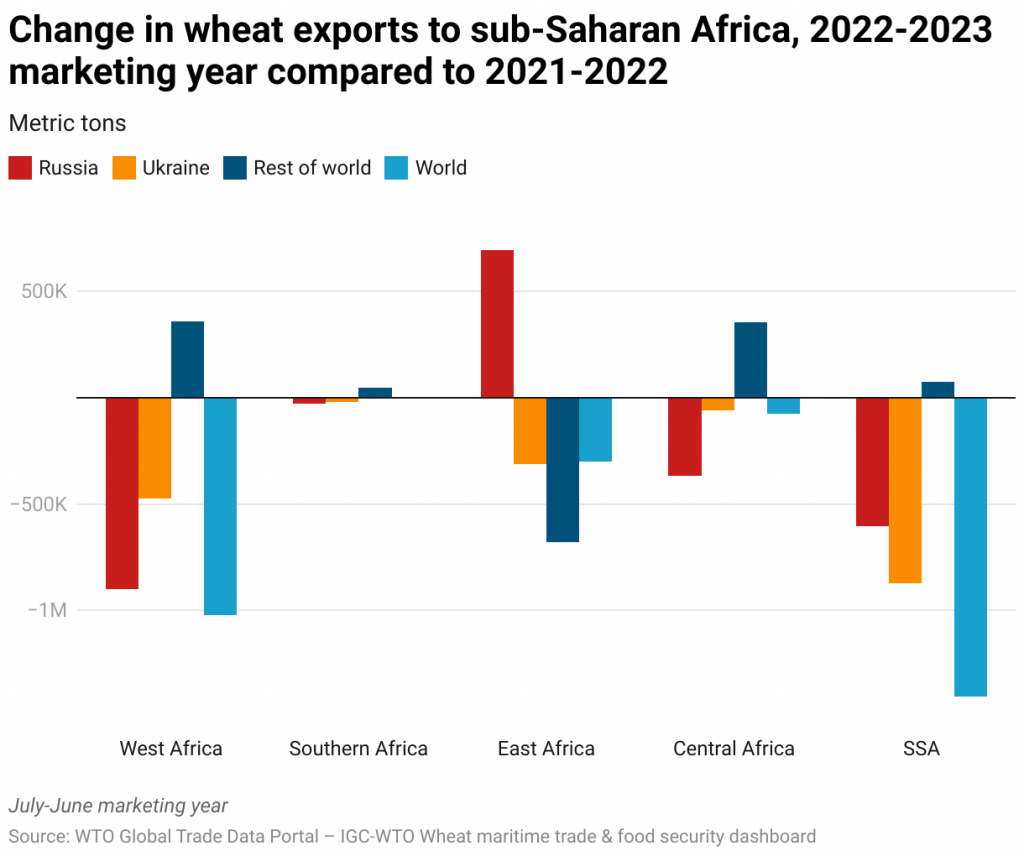

Russia exported more wheat to East Africa during 2022-23 than in 2021-22, but less to other parts of sub-Saharan Africa and thus less overall to the whole region (Figure 6). Ukraine exports to SSA in 2022-23 were confined to East Africa (largely reflecting World Food Programme exports through the Black Sea Grain Initiative). Yet even those totals were down 31% from 2021-22.

On balance, then, wheat exports from the rest of world partially offset the decline of wheat exports from Russia and Ukraine in West, Southern and Central African countries, but were down in East Africa. Overall, global wheat exports to Africa declined in every region, though most substantially in West Africa (down 1 million MT and accounting for 70% of the decline in total wheat exports to SSA).

Figure 6

Conclusion

Much of the rhetoric surrounding the termination of the Black Sea Grain Initiative has focused on the potential loss of exports to sub-Saharan Africa, but our analysis suggests that the likely impacts on wheat imports will be small and largely be felt through higher global prices. Ukraine’s wheat exports in 2022-2023 to SSA were largely confined to shipments from the World Food Programme to Ethiopia, Kenya, Sudan and Somalia. The end of the BSGI likely means those shipments to SSA could be significantly reduced in 2023.

For Russia, the effects are less clear. Forecasts by the U.S. Department of Agriculture, the International Grain Council, and the Agricultural Market Information System project show continued large Russian wheat exports for the 2022-23 marketing year, consistent with the shipment data presented above; however, most of the country’s recent rise in exports has gone to the Middle East and Northern Africa, leaving SSA with smaller supplies. Shipment data suggest that West African countries may have been affected the most by this tenuous situation, as export declines from Russia and Ukraine were only partially offset by exports from other suppliers. Whether Russia makes good on commitments to supply more wheat to SSA in 2023-2024 remains to be seen.

The end of the BSGI has brought a period of renewed disruption to global commodities markets and countries that have relied on wheat exports from Russia and particularly Ukraine. Of course, for many SSA countries, wheat is a smaller source of total daily calories than in North Africa, the Middle East, and many countries in Central Asia. Higher flour and bread prices will put strains on households, particularly in urban areas, but a smaller import dependency in overall diets means that these households will be more insulated from price increases than households where wheat consumption is a far larger share of diets.

Joseph Glauber is a Senior Research Fellow with IFPRI’s Markets, Trade, and Institutions (MTI) Unit; Soonho Kim is MTI Senior Data Manager; Elsa Olivetti is an MTI Research Assistant; Rob Vos is MTI Director. Opinions are the authors’.